download the template

A Shareholders Agreement is a contract between a company and its shareholders outlining how the company will be managed and stating the rights, duties and obligations of the shareholders. The purpose of this agreement is to protect the rights of investors (who are also shareholders) and their investment and establish a fair relationship between.

This is a simple shareholders’ agreement intended for use by small to medium sized growth companies.

This agreement sets out matters relating to the management of the company and the relationship between the shareholders (e.g. rights to appoint directors, matters requiring the approval of any investor-appointed directors, the provision of financial information, confidentiality provisions, etc). Consider whether a shareholders’ agreement is required – in some cases a shareholders’ agreement will not be needed as the basic requirements relating to the company can be included in the constitution (e.g. pre-emptive rights and tag-along and drag-along rights).

This agreement is not intended for use by services companies where shareholders work in the business the focus is on returning regular income to those shareholder based on their contribution to the business – i.e. companies where the shareholders work in the business like partners in a professional services firm. Our template shareholders’ agreement – services companies is a better starting point for this type of company.

This agreement does not contain a mechanism to force the resolution of a dispute between shareholders, for example by requiring the business to be sold and the company wound up if there is a major dispute between shareholders. These types of provisions can be problematic in startup tech companies, as it can be very difficult to value or sell the business in the early stages. Also, it is often not in founders’ interests to give this right to a disgruntled shareholder, and we usually advise against giving such a right to incoming investors as it provides a forced liquidity option. However, while we think this is generally the best approach for this type of company, the downside is that if shareholders cannot resolve a dispute between themselves commercially, it may fester and the company may become dysfunctional and/or deadlocked.

Our services company template includes a major disputes wind up clause which may be included in this agreement if the parties determine that it is appropriate.

using our templates

Use of a template by business users is free of charge and is subject to you agreeing to our template terms of use.

A Shareholder Agreement affects the shareholders of a corporation. It is a formal contract that sets out and explains the structure and nature of their relationship to the corporation and to one another. Corporations find this type of agreement to be highly valuable because it helps to create a strong foundation for the corporation as a whole.

The owners and directors of the company will interact with one another based on this agreement, so it needs to be strong, thorough, well thought out, and without loopholes, ambiguous wording, or other problems.

As a direct line between the corporation’s shareholders and directors, this agreement provides information on the expectations of all parties to the agreement. Legal problems can arise from misunderstandings, and this document reduces the level of misunderstandings so there are fewer risks of lawsuits and related difficulties.

However, these agreements can also become too restrictive, so it is important to ensure that proper wording is provided and the parties to the agreement all understand what is being asked of them.

When Do I Need a Shareholder Agreement?

If you are a corporation

Corporations will generally want to make a Shareholder Agreement. These are not legally required to form a corporation in all states, but they can and do offer protection and information that are both very valuable for shareholders and directors alike.

If you have outside investors

Additionally, if the corporation plans to take money from outside investors, this document will almost definitely be needed. Anyone who invests in a corporation will want to know how that corporation intends to use their money and what they will be getting for their investment.

They also want to know when they can expect dividends and anything else they are supposed to get from their shares, and without a clear document providing that information, they may choose not to invest.

It is important to understand that this document is not required to create a corporation, and that some smaller corporations that are not expecting to take any outside money from investors choose not to create one.

The Consequences of Not Having a Shareholder Agreement

Even though this document is not required, there can be serious consequences for not having one available and in use. The two biggest consequences are a lack of funds coming in and disagreements that take place between the shareholders and/or directors that are then not easily solved. These are both serious problems, and can affect corporations very strongly if they are not dealt with the correct way.

Investors generally want to see a shareholder agreement

Investors are not usually comfortable with providing money to corporations that are not well organized, and that do not show a clear way for those investors to get their money back through dividends and other means. In short, investors invest because they see the value of doing so.

When they no longer see that value, they can end up withdrawing their support. Before they invest, they will carefully study the corporation so they can make a good decision that will benefit them in the short term and in the long term. Corporations without these agreements do not show investors what they need to see in order to feel comfortable with how they will get their investment back over time.

Disputes will be harder to resolve

Additionally, many agreements that belong to small corporations are only created when there is a problem developing. By that time, it can be very hard to create an agreement of this type, because arguments have ensued.

Shareholder Agreement Template Microsoft Word

Rather than allow things to get to that point, creating a Shareholder Agreement right away will reduce problems and the risk of disagreements down the line. If there are disagreements at a later date, the agreement will be something that all of the shareholders and directors can be held to, so there are no legal ramifications from not having a proper agreement available.

You lose the chance to better stabilize your business in its infancy

Most corporations understand that the best time to create this agreement is early on, but in some cases they avoid making a one. When they fail to create one, they generally find that they only need it when problems appear.

By then, of course, it is too late to come up with an agreement that everyone can agree on and that is fair to all, because there is too much dissent among the ranks. When it is created right from the beginning, everyone is agreeing to it on good terms. That is the best time to make sure the agreement is fair and just to all of the shareholders and directors of the company, instead of only to some.

Strong-arm tactics are more common when shareholders are already struggling to get along with one another, and they may not get along as well later on as they did in the beginning. That can be a serious concern for all parties, but if there is no agreement in the beginning there is little that can be done once things go bad.

Simple Shareholder Agreement

Stay on top of your legal responsibilities and obligations by making sure you have all the correct legal documents in order. Check out our extensive range of legal documents for businesses.

The Most Common Shareholder Relationships

The majority of relationships come through family, or through employees.

How Do Family Members Become Involved?

A person may own a corporation, and decide to make their children and other family members shareholders. By doing that, they give those family members shares of the corporation, which have value. But they also likely want to make sure they are keeping majority control over that same corporation, so they will need to:

- be careful how many shares they give or sell

- not give too much to the same person

- pay close attention to buying/selling shares

- create restrictions to ensure they keep majority control

When an Employee Becomes Involved

Many corporations allow employees to purchase shares of the company, and in some cases those shares are gifted to employees for specific reasons or milestones. It is important that the corporation keep track of:

- who is getting what shares

- in what numbers

- the power and relationship balance

With that in mind, however, there are a number of ways that a corporation can make sure employees are getting shares and that the corporation is still keeping proper control. One of those ways is through a Shareholder Agreement, which will spell out the relationship in more detail and help ensure that everyone understands their roles, rights, and responsibilities. When this is not done correctly, or not done at all, the relationships can suffer and can also become more confusing.

That can cause problems for people who own corporations, and also for their family members and employees who may own shares of the corporation but not understand what the value of that ownership is or if there is something they are supposed to do with the shares in order to get their maximum benefit. They may also expect more from the ownership of those shares than the corporation is planning to give, which can leave shareholders frustrated and angry over the misunderstanding.

What Should be Included in the Shareholder Agreement?

The Shareholder Agreement is not a requirement for a corporation, so there is technically nothing that “should” be included in it, in the sense that there are no specifics that have to be in it, in order to make it valid. These agreements are very flexible documents, so they can be tailored to the corporation to which they belong and can provide proper and accurate information to the directors and the shareholders.

Generally, though, the latter will have a hand in the decision-making power of the directors and the corporation, so they can help to steer the corporation forward in a way they feel good about.

The agreement should also include:

- majority and minority shareholders

- the difference between those two categories

- why it matters

- that investment money is not needed for shares

- how to transfer shares

The power to make decisions or have a seat on the board of directors of a corporation goes to the majority shareholders, and will not go to minority ones in the vast majority of cases. Because of that, shareholders need to know what they own and where they stand, based on how the corporation expects to treat them and what it requires from them in their particular role.

Furthermore, consider the following elements when creating a shareholder agreement:

- Who the directors are

- Who the shareholders are

- What happens if one dies

- How shares are given to or sold to individuals

- How shares are sold back to the company or to others

- How dividends are paid from owning shares

- Any other perks that are given to parties to the agreement

- Any rights and responsibilities the parties have

This agreement will help reduce the chances that people may misunderstand what they must do in order to be shareholders, and that can reduce anxiety and related problems.

When it comes to corporations, it is important that their shareholders know what they are required or not required to do, so they do not end up making decisions based on erroneous information. A provision for other shareholders to buy the shares of those deceased or retiring is generally also included in this agreement, to make sure these shares can be dealt with and valued appropriately.

Shareholder Agreement PDF Sample

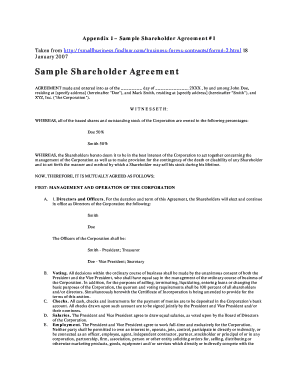

The sample shareholder agreement below details an agreement between ‘ABC, Inc.’ and the shareholders, ‘Roberto J Williamson’ and ‘Alice J Macarthur’. Roberto J Williamson and Alice J Macarthur agree to their duties regarding the management and supervision of the company.